A Guide to dividend tax

Melanie Richardson

03/09/2025

When limited companies make a profit, they can distribute those profits to shareholders in the form of dividends. For business owners, it is important to have an informed approach to dividend payments to maximise potential tax advantages.

This guide explores how dividends are taxed and covers the implications for both businesses and individuals.

What are dividends?

Dividends are a means of distributing profits to shareholders of limited companies. They can be paid when a limited company makes a profit after the deduction of corporation tax and all allowable expenses.

Who can receive a dividend?

Dividends are paid to those shareholders who own shares in a company. The amount received is typically proportional to the number of shares owned, although payments can be varied by the introduction of different classes of shares.

How are dividends taxed?

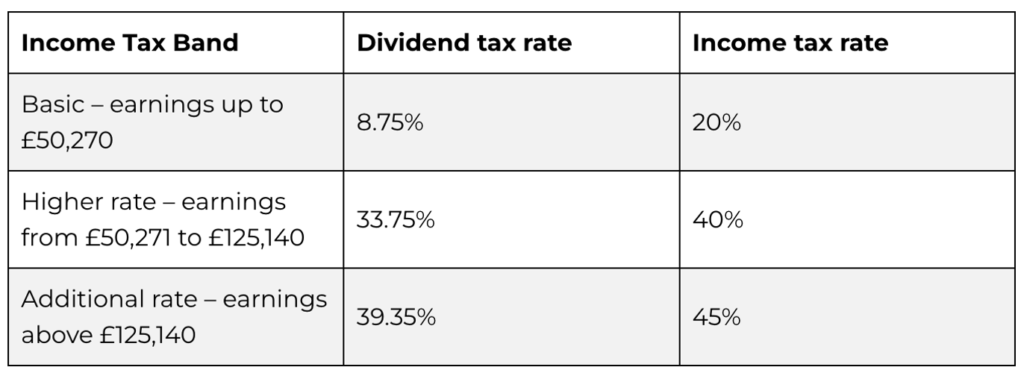

As with any income you receive, you may have to pay tax – although at the moment dividend tax rates are lower than income tax rates.

For the 2025/26 tax year, the dividend tax rates in the UK are based on income tax bands and are as follows:

What are the tax free allowances?

In the 2025/26 tax year, you won’t need to pay any tax on the first £500 of dividend income you receive. This is called the tax free dividend allowance. This was cut from £1,000 in 2023/24. In addition to this, you also have the standard personal allowance for income tax of £12,570.

To take advantage of the tax on dividends, directors often choose to be paid a lower salary combined with the payment of dividends.

Do you pay corporation tax on dividends?

Dividends are paid from post corporation tax profits (i.e. after the deduction of corporation tax) to individuals or other companies. Therefore dividends do not affect a company’s corporation tax bill.

Do you pay National Insurance on dividends?

At the moment, national insurance contributions are not payable on dividends. This may change on the upcoming budget.

Is there a limit to the amount of dividends I can pay myself?

The amount you can pay yourself in dividends depends on the profits your company generates and your personal tax situation. However, it’s important to ensure that you have enough profits available for distribution and to consider any tax implications, including the dividend tax rates and thresholds mentioned above.

When should I not take dividends out of my company?

A company cannot declare dividends if it has not made a profit and has no reserves carried forward from previous years.

Do I need to file a tax return for dividends?

If you already submit a tax return you can report any dividend income on your return. You must do this by the deadline.

If you do not submit a tax return, you must let HMRC know before 5 October of the following tax year. You can do this by either:

- asking HMRC to update your tax code - the tax will be taken from your wages or pension

- contacting the HMRC helpline

You do not need to tell HMRC if your dividends are within the dividend allowance for the tax year.

Sign up to receive our private content

straight to your inbox