Are you prepared for the April 2022 tax changes?

Melanie Richardson

15/02/2022

April 2022 will see the rates of most classes of National Insurance Contributions temporarily increase by 1.25 percentage points starting 6 April, to raise funds for the NHS and social care. This will be replaced by the Health and Social Care Levy from 6 April 2023, which will also be set at 1.25% of income. This article will discuss what the changes are and why now is a good time to plan your finances.

What are the changes?

National Insurance contributions increase

From 6 April 2022 to 5 April 2023 National Insurance contributions will increase by 1.25 percentage points. The government has ammounced that this will be spent on the NHS and health and social care in the UK.

The increase will apply to:

- Class 1 (paid by employees)

- Class 4 (paid by self-employed)

- secondary Class 1, 1A and 1B (paid by employers)

The increase will not apply if you are over the state pension age.

For further information follow the link below

https://www.gov.uk/national-insurance/how-much-you-pay

The chancellor has also announced that in order to ensure that taxpayers who take their income in the form of dividends also pay their fair share of tax, all the tax rates applicable to dividends will also rise by 1.25% percentage points from 6 April 2022.

If you’re an employer

If your business pays class 1, class 1A or class 1B National Insurance contributions, you’ll need to start paying the 1.25% increase in contributions from 6 April 2022. You’ll then need to pay the separate 1.25% levy from 6 April 2023.

You may also have to pay the separate levy from 6 April 2023 for employees who are over state pension age.

Health and Social Care Levy

From 6 April 2023, the National Insurance contribution rates will go back down to 2021 to 2022 levels, and the levy will become a separate new tax of 1.25%.

The separate levy of 1.25% will apply for the following classes of National Insurance contributions:

- Class 1 that are above the primary and secondary thresholds

- Class 1A and class 1B for employers

- Class 4 for the self-employed

All existing National Insurance contribution reliefs will apply to the separate levy for:

- employees under the age of 21

- apprentices under the age of 25

- qualifying Freeport employees

- those eligible for the Employment Allowance

- armed forces veterans

HMRC will collect the levy through existing PAYE payroll and self assessment systems.

For individuals who take their income in the form of dividends, all the tax rates applicable to dividends will also rise by 1.25 percentage points from 6 April 2022. The combination of these two rate rises will have a significant effect on the tax and NIC payable by shareholders of family companies.

For more information follow this link

https://www.gov.uk/guidance/prepare-for-the-health-and-social-care-levy

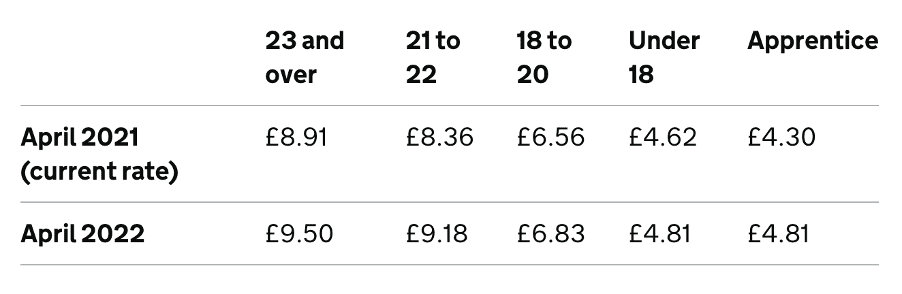

Increase in National Living Wage and National Minimum Wage

These rates are for the National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age). The rates change on 1 April every year. If you are an employer, it’s crucial to plan in advance for NIC rises and wage rises.

Making Tax Digital

from 1 April 2022, all VAT registered businesses will be required to submit their VAT returns using MTD compatible software and to keep their VAT records in a digital format. HMRC is introducing a new system of penalties to try to encourage taxpayers to comply with MTD and to pay their VAT on time.

Plan ahead now

The next few months provide an opportunity to plan for potential tax increase pressures on yourself or your business. There are many ways to ensure that your business is as tax efficient as possible. If you have any questions about the changes or if you are doing everything you can be, please get in touch with your Swindells partner who will be able to advise you further.

Sign up to receive our private content

straight to your inbox