Charities Act 2022 – get ready for the changes…

Melanie Richardson

02/09/2022

The new Charities Act 2022 will include several changes overriding the Charities Act 2011. It was announced that the changes have been made in an attempt to reduce red tape and administration, through wider freedoms given to trustees. This article will outline the proposed changes and timelines which span from Autumn 2022 through late 2023.

Some of the key changes include:

Paying trustees for providing goods to the charity

Charities already have a statutory power that they can use, in certain circumstances, to pay trustees for providing a service to the charity beyond usual trustee duties, or goods connected to that service.

This statutory power is being changed by the Charities Act 2022. As a result, charities will be able to pay trustees in certain circumstances for just providing goods to the charity.

So, using the statutory power, trustees could be paid for:

- services only, for example estate agency or computer consultancy

- services and associated goods, for example plumbing or painting service and any associated materials such as plumbing parts or paint

- following implementation of the Act in autumn, goods only, for example supplying stationery to the charity

Making moral or ‘ex gratia’ payments from charity funds

Sometimes charity trustees receive a request to make a moral, or ‘ex gratia’, payment from their charity’s funds or property, or to waive their right to receive funds or property. This most frequently occurs when a charity receives a legacy and there is evidence that the donor had changed their mind since making their will.

The Charities Act 2022 will introduce new powers which will enable:

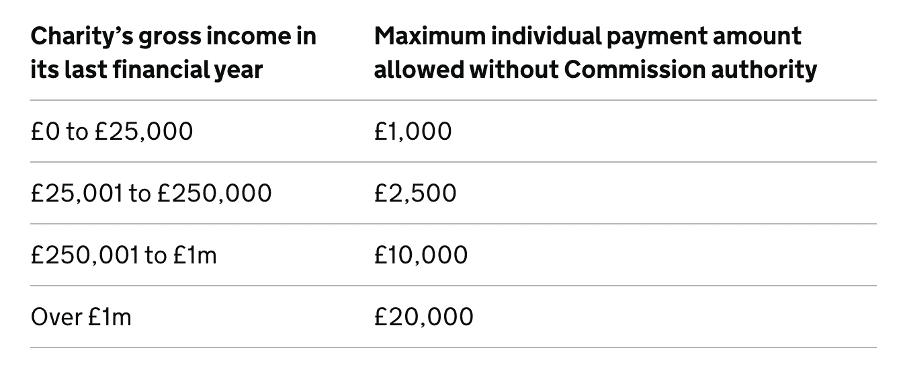

- charities, where trustees could reasonably be regarded as being under a moral obligation, to process requests for ‘small’ amounts without applying to the Commission, based on factors like annual gross income and the amount of the request (see the table below)

- trustees to delegate the decision-making for ex gratia payments to other individuals or groups within the charity. For example, the chief executive or a trustee sub-committee

These powers will also be available to Royal Charter and statutory charities.

The thresholds for enabling charities to use the new statutory power are set out in this table.

If the payment exceeds the amount set out in this table, you must continue to apply to the Commission for authority to be able to proceed.

Fundraising appeals that do not raise enough or raise too much

Sometimes, appeals for funds do not raise the amount needed to deliver the aim the trustees wanted, or raise too much so that there are funds leftover. It may be that circumstances may change, and the charity cannot use the donations as it originally intended.

The Charities Act 2022 aims to reduce complexity surrounding the actions that trustees can take in these situations. For example:

- the current requirement in some circumstances for charities to wait six months for donors to ask for a refund will no longer apply.

- there will be a simpler process for obtaining our authority; this will replace the need for the Commission to make a scheme.

- if the donations that can be spent on new purposes (different to the purposes you raised them for) are less than £1000, trustees can act without the Commission’s involvement if they comply with the new legal requirements.

- Power to amend Royal Charters.

- These charities will be able to use a new statutory power to change sections in their Royal Charter which they cannot currently change if that change is approved by the Privy Council.

Other provisions

Other changes as set out in the Act that are coming into effect in the autumn of 2022:

- confirmation that the Commission’s scheme making powers include making schemes for charitable companies.

- The granting of trust corporation status automatically to existing and future corporate charities in respect of any charitable trust of which the corporation is (or, in the future, becomes) a trustee.

- An update to provisions relating to giving public notice to written consents and orders of the Charity Commission under various sections of the Charities Act 2011.

- Confirmation that when a charity changes its governing document by parliamentary scheme under section 73 of the Charities Act 2011, the scheme will by default always be under a lighter touch parliamentary process (known as the negative parliamentary procedure)

An overview of the full changes can be found here

Sign up to receive our private content

straight to your inbox