Late tax payment penalties to change

Melanie Richardson

26/09/2021

The government is changing the penalties charged for late submission of returns and late payment of tax it has been announced. The changes will initially apply to VAT and Income Tax Self Assessment (ITSA). As part of this reform, interest charges and repayment interest will be harmonised to bring VAT in line with other tax regimes.

The changes will apply to:

- VAT returns for periods beginning on or after 1 April 2022

- Self assessment tax returns with business or property income over £10,000 per year (who are required to submit digital quarterly updates through Making Tax Digital for ITSA) for accounting periods beginning on or after 6 April 2023, and to all other ITSA taxpayers for accounting periods beginning on or after 6 April 2024.

Late payment penalties

There are two late payment penalties that may apply. A first penalty and then an additional or second penalty.

First penalty

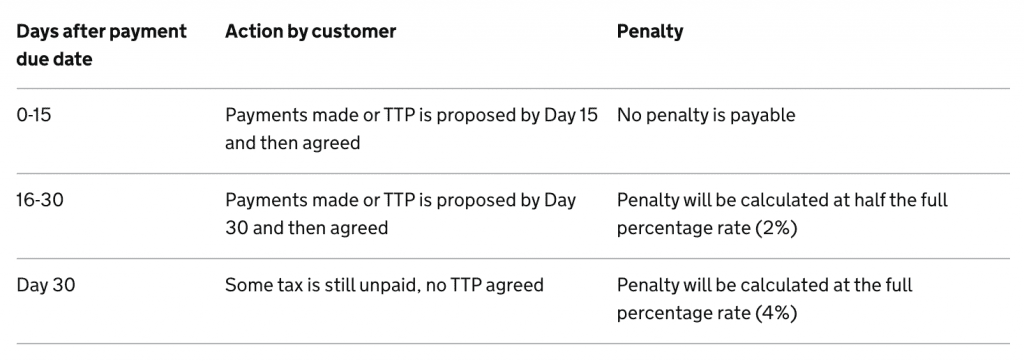

The first penalty is charged 15 days after the payment due date. The penalty is 2% of the tax outstanding. If any of this tax is still unpaid after day 30, the penalty will be calculated as 2% of the tax outstanding after day 15 plus 2% of the tax outstanding at day 30. In most instances this will amount to a 4% charge at day 30.

Additional or second penalty

If tax remains unpaid on day 31, an additional penalty starts to build up. It accrues daily at a rate of 4% per annum on the outstanding amount.

Time To Pay Arrangements

HMRC is currently offering taxpayers the option of requesting a Time To Pay (TTP) arrangement. Once a TTP is agreed, penalties will stop accruing as long as the TTP agreement is in place and the payment terms are met. The examples below illustrate how TTPs work, and the effect of a TTP is shown in this chart

For more information please visit the government’s policy paper using the link below

If you have any questions please do get in touch with your Swindells partner who will be able to advise you further

Sign up to receive our private content

straight to your inbox