The HMRC app

Melanie Richardson

04/04/2024

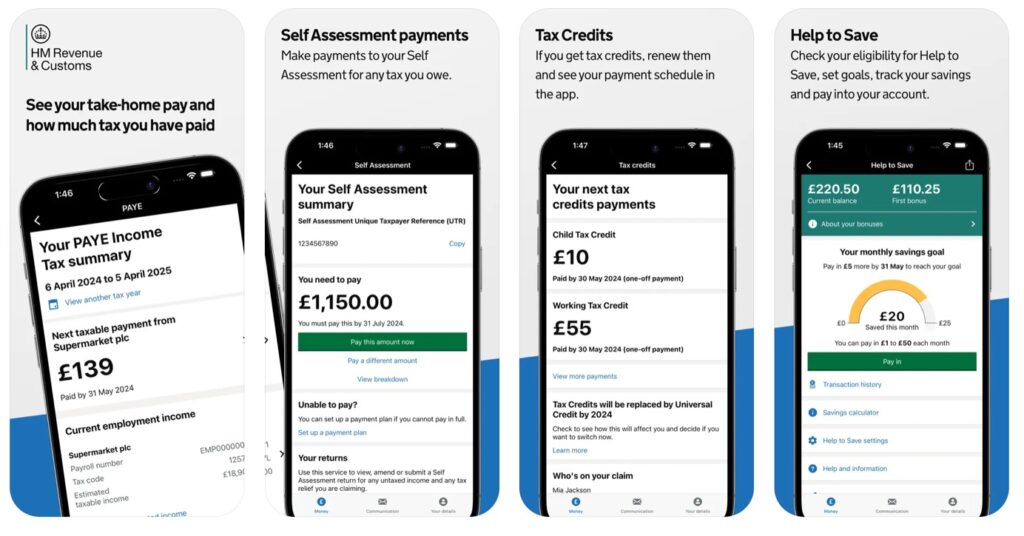

In recent months, HMRC has been under pressure to reduce wait times on their phone lines and the new HMRC app is hoped to start to relieve the pressure on the phones. Here is a quick summary of what you can achieve with the new app and how to download it.

What the app does

The HMRC app is designed to be a quick and easy way to get information about your tax, national insurance, tax credits and benefits.

You can use it to check:

- your tax code

- your National Insurance number

- your income and benefits

- your employment and income history from the previous 5 years

- how much you will receive in tax credits and when they will be paid

- your Unique Taxpayer Reference (UTR)

- how much tax you owe

- your Child Benefit

- your State Pension

You can also use it to:

- get an estimate of the tax you need to pay

- make a tax payment

- set a reminder to make a tax payment

- report tax credits changes and complete your renewal

- access your Help to Save account

- use the tax calculator to work out your take home pay after tax and NI

- track forms and letters you have sent to HMRC

- claim a refund if you have paid too much tax

- ask HMRC’s digital assistant for help and information

- update your name

- update your address

- save your NI number to your digital wallet

- choose to be contacted by HMRC electronically, instead of by letter

How to access the app

Open the app and enter your Government Gateway user ID and password to sign in for the first time. If you do not have a user ID, you can create one in the app.

You should then be able to access the app by signing in using either:

- a 6-digit PIN

- your fingerprint

- facial recognition

Watch the HMRC video on YouTube https://www.youtube.com/watch?v=GoOE6NW2dho

Download here on Android https://play.google.com/store/apps/details?id=uk.gov.hmrc.ptcalc&hl=en&gl=US

Download here on iPhone https://apps.apple.com/gb/app/hmrc/id514561561

Sign up to receive our private content

straight to your inbox